Strong container throughput drives Port of Antwerp-Bruges growth despite challenging market conditions

Positive trend in container throughput perpetuated; geopolitical situation depresses growth in other product groups.

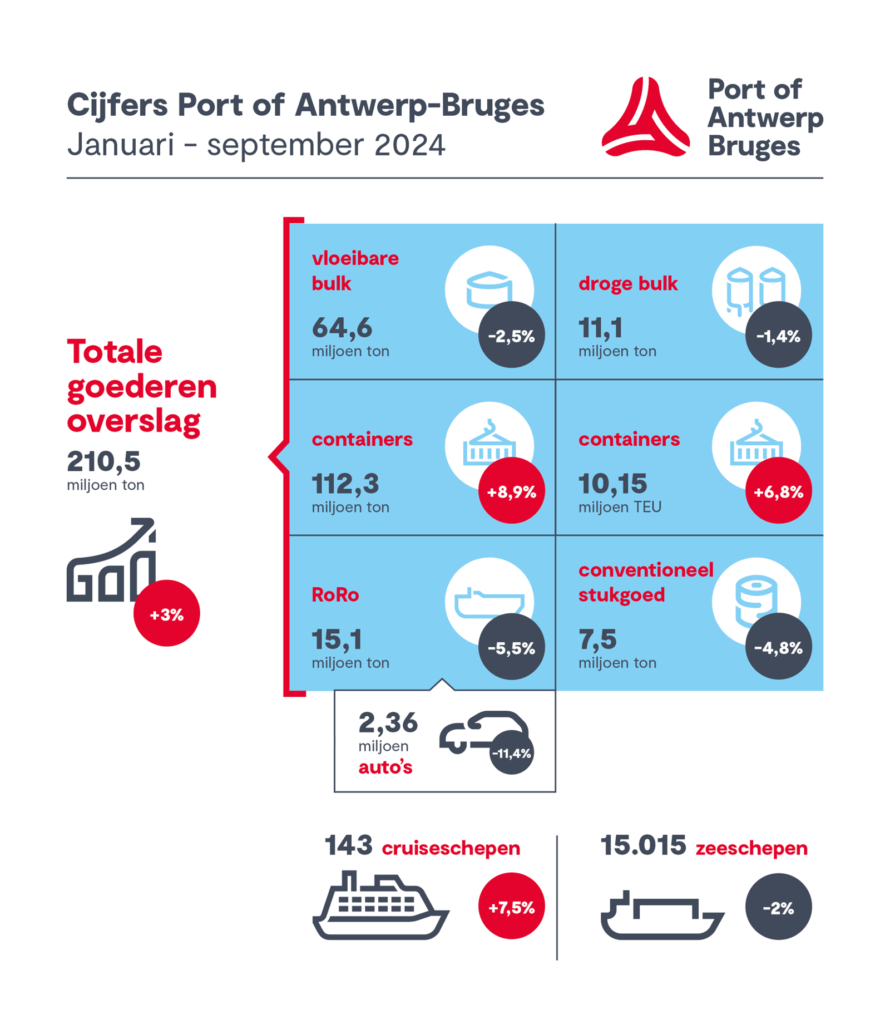

After nine months, Port of Antwerp-Bruges records a total cargo throughput of 210.5 million tons, an increase of 3% compared to the same period last year and a stabilization compared to the second quarter. The increasing demand for container traffic continues, while the continuing unstable geopolitical and economic conditions do impact other cargo flows. Despite the challenges, the port continues to invest in sustainable and innovative projects aimed at energy transition and industrial growth.

The container transshipment in tons increased by 8.9%, with landings increasing by 10.2% and discharges by 7.9%. The growth of the first half of the year continued in the third quarter, with 12.3% more containers handled (TEUs) than in the same quarter last year.Over the first 9 months, total container throughput in TEUs increases by 6.8% to 10,152,000 TEUs.

In the first half of this year, Port of Antwerp-Bruges' market share in container handling in the Hamburg - Le Havre Range increased by 0.8 percentage points to 30.7% compared to 2023.

Nearly 1 in 10 of the containers handled is a reefer container. In the first 9 months of 2024, the number of full refrigerated containers (reefers) with 9.7%, accounting for 8.5% of total container traffic. These temperature-controlled containers carry products such as fresh fruits, vegetables, meat, fish, pharmaceutical goods and chemicals. Thanks to its strategic location, fast maritime connections and specialized terminals, Port of Antwerp-Bruges confirms its strong position in the reefer segment.

Although conventional general cargo performed strongly in the second quarter, throughput declined in the third quarter, leaving total throughput in the first 9 months of 2024 4.8% lower than last year. Iron and steel decreased slightly by 0.6%, with outflows (+4%) partially offsetting the decrease in landings (-3.5%). This decline is due to lower demand from steel processing sectors such as construction and automotive. Products such as wood (-32.9%), paper and cellulose (-22.6%) and building materials (-36.9%) also experienced declines, while non-containerized transshipment of fruits, vegetables and other refrigerated cargo increased by 4.1%.

The roll-on/roll-off traffic decrease by 5.5%. Although pressure on car terminals decreased, this was due to lower arrivals, not accelerated discharges to customers. Transshipment of transport equipment declined by 13.3%. Transhipment of high & heavy (-23.5%) and trucks (-10.3%) declines, as does transhipment of used cars (-42.6%). After a strong increase in 2022 and 2023, the transshipment of new cars, in the first 9 months of this year declines by 11.4%.

Transhipment of unaccompanied cargo (excluding containers) via RoRo ships in Zeebrugge increased by 2.8%. The decrease in traffic to and from the United Kingdom (-4.1%) is more than compensated by an increase in transshipment to and from Spain and Portugal (+35.7%), Scandinavia (+16.7%) and Ireland (+2.2%).

The transshipment of dry bulk declines by 1.4%, mainly due to a sharp drop in coal transshipment (-55.3%). Indeed, dry bulk, excluding energy products such as coal and wood pellets, grows by 9.5%. Fertilizers, the largest product category in this segment, continues its growth (+30.6%) after a sharp decline in 2022 due to sanctions and high gas prices. Other building materials and non-ferrous ores also grow by 7.3% and 4.8%, respectively, while sand & gravel (+0.1%) and scrap (-0.7%) remain more or less stable.

The transshipment of liquid bulk declines by 2.5% after 9 months, due to lower volumes of liquid fuels (-8.9%) and LNG (-10.2%). Especially diesel transshipment (-23.1%) falls due to weak demand, while LPG (+8.8%), fuel oil (+8.4%), naphtha (+2.9%) and gasoline (+2.3%) show growth. Chemicals transshipment increases by 9.3%, partly due to the strong increase in biofuels transshipment (+52.5%). Even without that effect, there is growth (+7%). Chemical gases (+9.5%) and basic chemicals (+8.6%) also showed positive figures. Despite this recovery, the European chemicals sector remains under pressure from high costs for energy, raw materials and wages, combined with low global demand.

In the first nine months of 2024, Zeebrugge received 412,774 cruise passengers (+17.5%) on 143 cruise ships. These were 10 more cruise ships than last year.

In the first nine months of 2024, 15,015 seagoing vessels arrived at the port, down 2%. The gross tonnage of these vessels decreased by 4.8% to 472.45 million GT.

Focus on energy transition and industrial growth

Despite continuing geopolitical and economic challenges, Port of Antwerp-Bruges' growth figures are stabilizing. The figures once again underscore the resilience of the port, which continues to pioneer and invest in a future-proof port in complex times where sustainability and economic growth go hand in hand. The expansion of Zuidnatie, which started this summer with the construction of a new warehouse for processing steel coils, and the acquisition of Liege Natie by Lineage confirm the port's importance in specialized segments. The recently announced investments, such as the fossil-free plastic production of Vioneo and Plastics-to-chemicals by Indaver that converts polypstyrene (PS) and polyolefins (PO) into recycled naphtha in turn strengthen the port's position in energy transition and sustainable innovation.

Port of Antwerp-Bruges continues to focus on strengthening its infrastructure and offering sustainable logistics solutions that contribute to the industry's efforts in CO₂ reduction and digitalization. Following the installation of one of Europe's largest public charging points for electric trucks in Antwerp, the first pile was driven in Zeebrugge for a truck parking with charging infrastructure. In addition, the CHERISH2O-project, which aims to treat and reuse industrial wastewater, contributes to the port's development as a circular hub.

Jacques Vandermeiren, CEO Port of Antwerp-Bruges: "Despite the complex times in which we operate, with geopolitical tensions, rising energy prices and global competition, we are stabilizing our growth, thanks in part to our strong position in container handling. Sailing around the Cape of Good Hope, cyber-attacks and other challenges force us to remain flexible and resilient. Together with our partners, we continue to build a future-proof port where innovation supports both sustainability and economic growth. Investments like those of Vioneo and Indaver reflect confidence in our port and in the future of European industry.."

Johan Klaps, port alderman of the City of Antwerp: "Our port is the economic engine of Flanders. To be able to immediately announce strong quarterly figures on my very first working day as port alderman is a moment of professional happiness. These strong quarterly figures, despite still particularly challenging times, underline the resilience of our port. We therefore continue to pioneer and invest in a future-proof port. Gratitude goes out to the entire port community for continuing to show this resilience and to Minister of Mobility, Public Works and Ports Annick De Ridder for her hard work as port alderman and chairman of Port of Antwerp-Bruges in recent years. Together with the port community, I am now committed to further realizing the strategic ambitions of Port of Antwerp-Bruges, with a strong focus on sustainability, innovation and strengthening our international position."

Dirk De fauw, mayor of the city of Bruges and vice president of Port of Antwerp-Bruges: "The stabilization of growth rates shows that our resilience allows us to turn challenges into opportunities. With our strategic location, excellent services and thanks to the two complementary port platforms, we confirm and strengthen our market position, such as in the reefer segment. The sustainable growth of this segment attracts investors, as demonstrated by the acquisition of Liège Natie by Lineage, the world's largest cold store operator."