Quarterly figures Port of Antwerp-Bruges reflect resilience

Container throughput picks up again

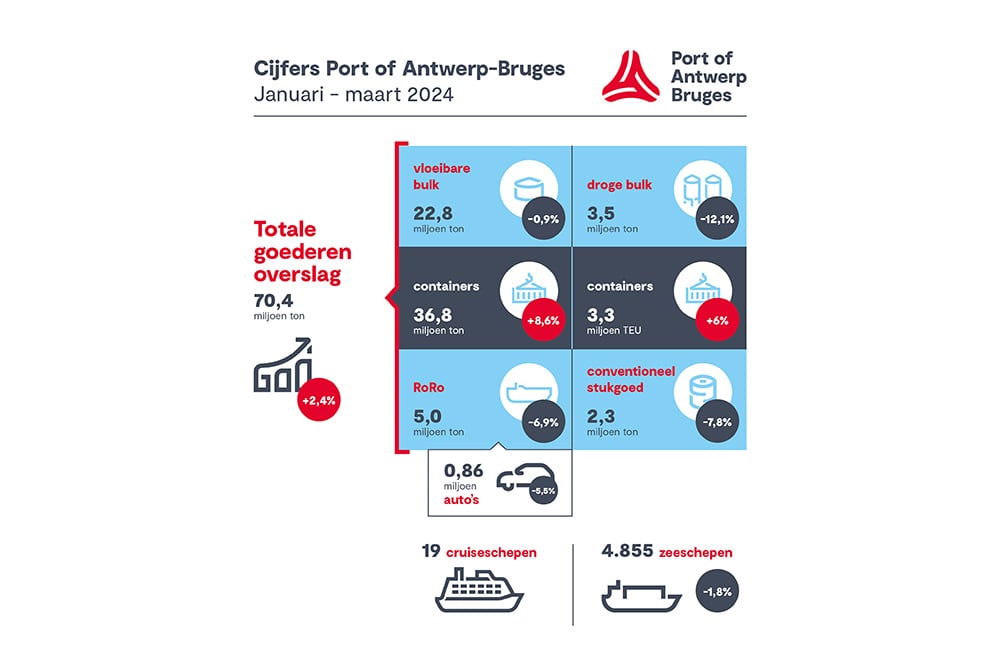

Port of Antwerp-Bruges' total cargo throughput in the first quarter of this year amounts to 70.4 million tons, an increase of 2.4% compared to the same period last year. In a still complex geopolitical and macroeconomic context, this growth, driven by once again rising container throughput, confirms the port's resilience.

After economic uncertainty and inflation caused a global slowdown in container shipping demand in 2023, as of February the container transshipment again, with March even recording the best monthly throughput since March 2021. This results in an increase in total container throughput of 8.6% in tons and 6% in TEUs (3,287,000 TEUs), compared to the first quarter of 2023. In 2023, Port of Antwerp-Bruges' market share in container handling in the Hamburg - Le Havre Range increased by 0.3% point to 29.9%.

The transshipment volumes of conventional general cargo again show an upward trend. Although the throughput is down 7.8% compared to the same period last year, compared to the last quarter of 2023, it is up 6.9%.

Handling of iron and steel remains status quo with landings growing (+1.4%) while discharges fall (-3.8%). For most other goods, there is a decrease compared to the first quarter of 2023.

The roll-on/roll-off traffic decrease by 6.9% in the first quarter of 2024. The continuing congestion at RoRo terminals translates into a decrease in the transshipment of all transport equipment (-8.7 %). The lower transshipment of used cars (-52.5%) in particular plays a role in this, as does that of high & heavy (-25%), trucks (-23.9%) and new cars (-5.5%). The transshipment of unaccompanied cargo (excluding containers) carried on RoRo vessels increased by 1.7%. The decrease in transshipments to and from the United Kingdom (-4.4%) is offset by an increase in transshipments to and from Spain and Portugal (+31.5%), Ireland (+6.4%) and Scandinavia (+13.5%).

While dry bulk outflow increases by 9.7%, supply falls by 24.4%, which translates into a decrease in the dry bulk segment by 12.1%. Now that the energy crisis is less acute, coal demand has fallen sharply again (-68.6%). Handling of fertilizers, the largest product category within dry bulk, is picking up again since the last quarter of 2023 (+33.9%), especially in landings. Handling of non-ferrous ores (+47.3%), and scrap (+5.7%) is also growing. Lower demand from the construction sector weighs on the transshipment of sand and gravel (-12.5%), and grains are again transported more in containers (-43.7%).

The transshipment of liquid bulk holds up relatively well with a slight decrease of 0.9%, with discharges increasing by 4.2% but landings decreasing by 4.1%. Growth is seen in the transshipment of fuel oil (+25.2%), gasoline (+12.1%) and LNG (+10%). And although the competitiveness of the European chemical industry remains under pressure due to the high cost of energy, raw materials and labor, the transshipment of chemicals and naphtha, due to recovering demand, increases by 5.2% and 12% respectively. The transshipment of diesel showed a decrease (-40%), as did that of LPG (-11.5%) and liquid fuels (-11.4%).

In the first quarter of 2024, 4,855 zeeschepen the port, a decrease of 1.8%. The gross tonnage of these vessels decreased by 2.4%.

In the first 3 months of 2024, Zeebrugge welcomed 99,211 cruise passengers on 19 cruise ships, 10.7% less than in the record first quarter of 2023.

Resilient and future-proof

That the quarterly figures show an increase despite the weak economic climate confirms the resilience of Port of Antwerp-Bruges, which continues to pioneer and invest even in challenging times to make the port future-proof.

For sustainable growth, the port must be able to accommodate the very largest container ships. The draft of 16 meters required to do so was recently achieved by the first container ship. In addition, a new record of the largest container volume handled on a single ship was set in March, on the MSC China with 26,201 TEUs.

The first methanol bunbarrier with a deep-sea vessel was another milestone in Port of Antwerp-Bruges' ambition to become a multi-fuel port and accelerate the energy transition in the maritime sector. Shore power also plays an essential role in this and with the Shore power installation for cruise ships in Zeebrugge as of 2026, the port runs ahead of European regulations.

The first demo projects confirmed for NextGen Demo, the innovation hub that is part of NextGen District, will make an important contribution to the energy transition and circularity in the port. Just as the Antwerp North heat grid, the first "open access" heat grid in Belgium to provide carbon-free heat.

Jacques Vandermeiren, CEO Port of Antwerp-Bruges: "That we as a global port are at the center of ongoing challenges became clear again last quarter. The perils in the Red Sea forced container shipping companies to divert via the Cape of Good Hope on the East-West routes for safety reasons, resulting in disruptions in logistics chains and peaks and troughs in arrivals of container ships. This required adjustment by all parties involved, but detours soon became the 'new normal'. That we can nevertheless once again record growth proves our resilience in unpredictable times."

Annick De Ridder, chairman of the Port of Antwerp-Bruges board of directors: "The increase in quarterly figures - with March even seeing the best container throughput in three years - proves that our port is a resilient world port. One that also continues to innovate and invest despite challenging times. Port of Antwerp-Bruges is therefore an ambitious pioneer port. As the economic engine of Flanders, together with our companies we are fully committed to sustainable growth. Last quarter this manifested itself, among other things, in the first methanol bunkering of a deep-sea ship, in a new record with the largest container volume handled on a single ship and the announcement of new initiatives at our innovation hub NextGenDemo."

Dirk De fauw, mayor of the city of Bruges and vice president of Port of Antwerp-Bruges: "These figures and the still growing market share of the container segment compared to the other ports in the Hamburg-Le Havre range are the best proof of the added value of the merger and the two complementary port platforms. As a merger port, together with the industry, we also continue to take essential steps in the energy transition towards a climate-neutral port by 2050. The shore power installation that will be operational at our cruise terminal in Zeebrugge by 2026 is a great example of this."