Involve insurers in the fire safety process

Fire safety in industrial construction: design with a broad perspective

A recent About Fire training and networking event focused on fire safety in industrial construction projects. Experts from various fields shared their insights on fire safety in leasing industrial properties during a panel discussion. The goal of this event was to provide participants with a framework that can serve as a starting point for further discussions on fire safety in the industrial sector. Mission accomplished. We zoom in on a few topics.

The panel discussion, led by An Laureys and Liesbeth Jacobs (Firesa), opened with the question of who is responsible for fire safety when leasing industrial buildings. The consensus was that both landlords and tenants have responsibilities. Each employer should have a fire prevention file, and there should be coordination between tenants and/or owners if they share the same building. In incidents, the damage should be compensated by whoever causes it. This is a basic principle. Liability insurance can cover these costs, but fire insurance for industrial buildings is not a requirement. Nevertheless, it is strongly recommended. Landlords can require in leases that tenants purchase fire insurance to cover property damage.

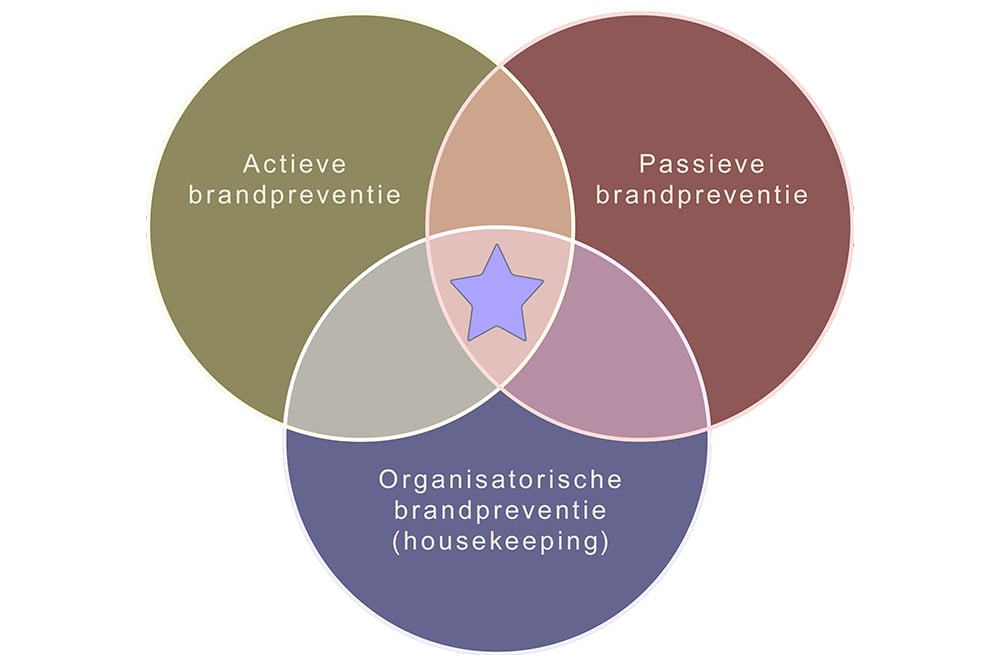

Gunter Peeters of Colruyt Group gave insight into their dynamic fire concept when renting and leasing industrial spaces. Colruyt keeps both active and passive fire protection in-house as much as possible and makes clear agreements in leases. If adjustments are needed to meet fire safety standards, Colruyt assumes the costs. The organizational aspects are also laid down by contract.

Stricter requirements in multi-occupancy

The panel also discussed the role of insurers and insurance brokers in insuring industrial buildings. Kristien Carnotensis, Safety Engineer at AXA Belgium, indicated that insurers are often not involved in the design of buildings. As a result, issues such as compartmentalization and types of fire protection systems come into the picture too late. Inspections of multi-tenant buildings are usually conducted annually, while single-tenant buildings are inspected every four to five years. Marc Marichal, Consultant Property Risks at Vanbreda Risk & Benefits, added that insurers may impose stricter requirements in the case of multi-occupancy on the same property. This could mean, for example, greater safety distances between buildings to avoid large concentrations of capital.

Sprinkler system

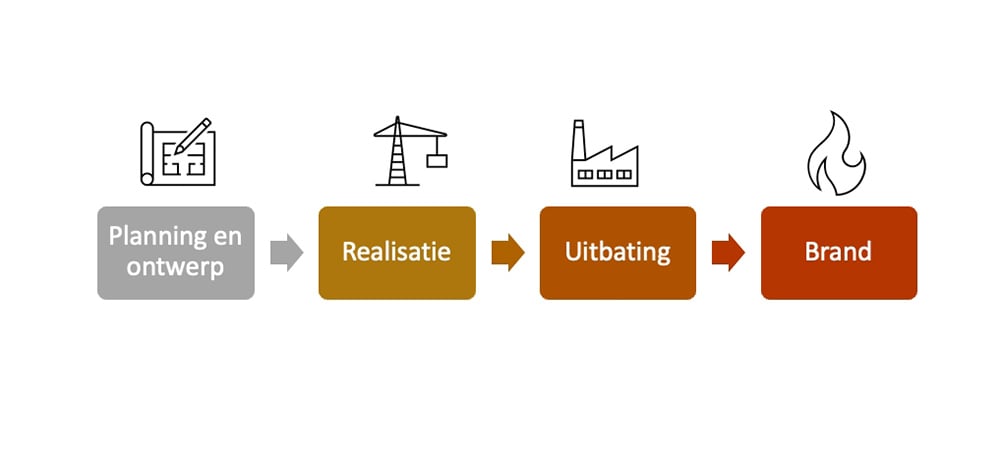

Martin Vujovic, Technical Manager at Aura Business, noted that for new construction projects, property developers usually do not cooperate with insurers, but rather rely on architects and construction companies to meet fire safety standards. In renovations and acquisitions of industrial buildings, however, insurers do get involved because fire safety can have a major impact on costs.

To reach the widest possible spectrum of the rental market, fire class C, the most stringent fire class, is usually chosen. The additional cost is passed on to the tenant or buyer. Marc Marichal added that a sprinkler system is not always suitable to adequately protect the tenant's property. This sometimes leads to insurers not wanting to insure the risk.

Weighing risks

And what about the balance between fire safety and burglary safety? Gunter Peeters indicated that Colruyt Group tries to combine both aspects in the concept phase, while Martin Vujovic noted that project developers usually pay less attention to burglary protection. The security aspect lies more with the tenant because they are responsible for insuring their contents. Kristien Carnotensis emphasized that the main issue with insurers is whether burglary can lead to fire or vandalism. It is a matter of weighing the risks.

The panel discussion concluded with three recommendations for the future: design with a broad perspective considering regulations and standards, commit to a solid lease agreement, and involve the insurer in the entire fire safety process.