How resilient is the logistics real estate sector?

After peak years due to the corona pandemic, take-up of logistics real estate in Belgium took a deep dive in 2024. Real estate consultant JLL calculated that absorbed volume was 37 percent lower than in 2023. The sector is under severe pressure, with numerous challenges radically changing the real estate landscape. At the same time, bright opportunities are popping up on the horizon that could give the logistics real estate market a new dynamism.

682,314 square meters. That's how much the volume of recorded logistics real estate in Belgium amounts to, according to JLL's calculations. According to the real estate consultant, retailers and e-commerce companies accounted for the largest share (48 percent), followed by logistics service providers (34 percent) and industrial users.

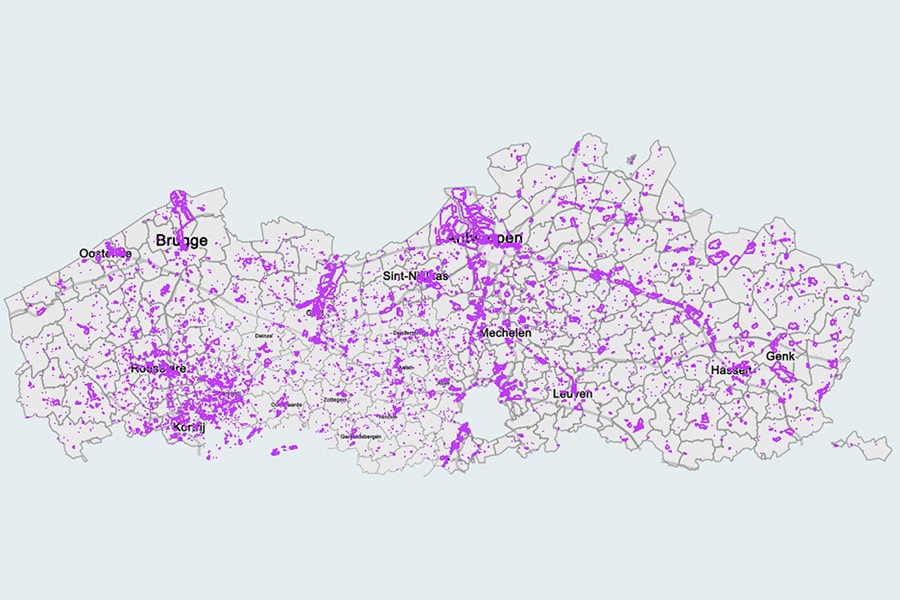

Another observation: the decreased volume in 2024 is accompanied by an increase in the vacancy rate of logistics space. On the important Brussels-Antwerp logistics axis, vacancy increased from 1 percent in 2023 to 3.46 percent in 2024. Although, according to JLL, this need not be alarming: during the corona pandemic, logistics players rented just about everything that was available, because they still had the certainty that this storage space would be utilized. Today, however, those circumstances look completely different.

The impact of a faltering economy

In September 2024, Stefan De Pauw, head of logistics at CBRE Belgium, confirmed the following in De Tijd: "During and after the corona period, leasing of logistics real estate went very smoothly. Many retail chains wanted to build up large stock due to supply problems. A lot of retailers then also rented more space than they actually needed to make sure they had enough space for their customers. Currently, we are seeing declining consumption due to the more difficult economic climate. Some retail chains are giving back retail space. Add to that the macroeconomic uncertainty - whether or not fueled by global geopolitical tensions - and you understand that this year will also be challenging for the sector."

Need for additional business space

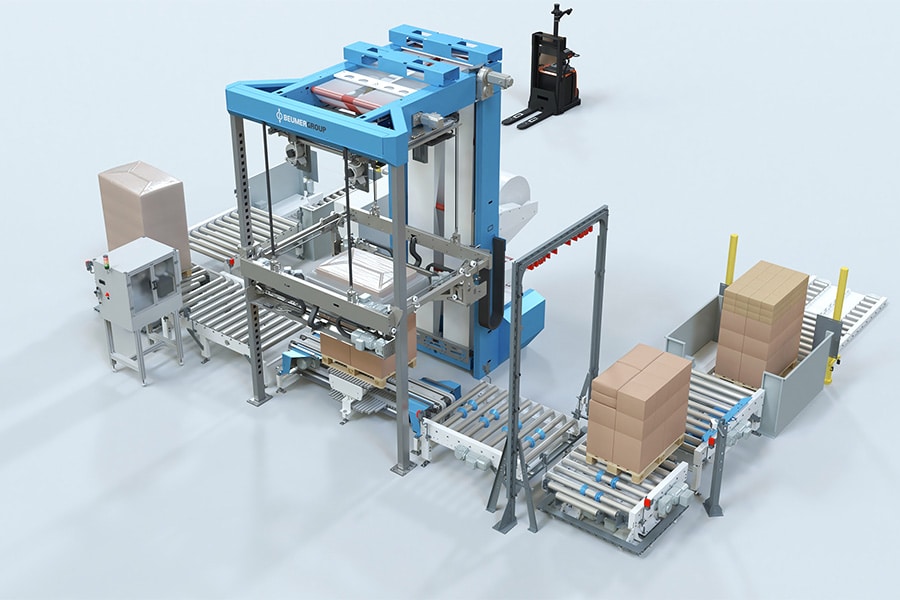

In addition to the economic downturn, the lack of available business space is also playing tricks on the logistics sector. And that space is more than desperately needed, thanks in part to the rising success of e-commerce. "In Europe, 14 percent of all consumer purchases go through e-commerce. According to studies, for every 1 billion euros of additional e-commerce sales, 100,000 square meters of additional logistics space is needed," Jo De Wolf, CEO of Montea, noted in the same newspaper in late December. Available (building) land has thus become an essential commodity for the sector, including greyfields and bronwfields to be redeveloped. Moreover, with the rise of e-commerce, companies are looking for ways to travel the last mile as efficiently as possible, close to city centers. In addition, the construction of high-rise warehouses is booming, as part of the solution to maximize use of available space. Such warehouses are ideal "testing grounds" for automated warehouse solutions, another challenge within the logistics real estate sector.

Automation versus staff shortages

This increasing automation - from collaborative robots to automatic sorting systems - offers the sector interesting perspectives for the future and can also help solve the shortage of skilled logistics personnel. Many automation software providers have been reviewed in this magazine. Each of them proposes innovative solutions, although smaller logistics market players do not always have the human and/or financial resources to invest in automation projects. Moreover, it is often the case that a logistics service provider groups several customers in a warehouse, each of which has its own logistics requirements and needs.

Slow permit procedures

Another bottleneck that plagues the logistics real estate sector: complex and time-consuming permit procedures for the construction or reconstruction of logistics facilities. In a previous edition of this magazine, Marc Dillen, ex-director general of Embuild Flanders, confirmed that in Flanders it takes an average of 3 years and 10 months to obtain a permit; in the Netherlands, those timescales are even longer. "Year after year, there are more permit applications, while the same number of officials have to handle an increasing number of permits," he said. "This bottleneck leads not only to delays in project implementation, but also to higher costs and a worse competitive position for Belgian industrial builders. We urgently need a (digital) simplification of administrative procedures."

Focus on sustainability

Last but not least, there is increasing pressure to meet international climate goals. Investors and tenants in logistics real estate are increasingly demanding sustainable buildings with energy-efficient systems and environmentally friendly materials. This transition involves significant investments and requires a review of existing infrastructure. On this front, too, we refer to Embuild Flanders: in its Vision Memorandum 2024, the sector federation clearly sees innovation as the engine for achieving Flemish and European climate goals. "New technologies such as BIM, artificial intelligence, prefabrication and circular building materials play a central role in this," indicates Caroline Deiteren as Marc Dillen's successor. "These technologies promise not only more efficient construction processes, but also a substantial reduction in construction waste and CO2 emissions. With the launch of Flanders Build, Embuild Flanders aims to address the fragmentation of knowledge and the lack of coherent innovation programs in the sector."